Japanese luxury beauty products maker Shiseido plans to start manufacturing in India as it scales up, joining global peers such as Estee Lauder Companies and The Body Shop, which are also in talks with local partners to kickstart or step up production in the country and tap into the world’s fastest-growing market in the segment.

“Local manufacturing would get the company inherent advantages, including lower duties, in the rapidly expanding India market,” Sanjay Sharma, country head of Shiseido Group in India, told ET. “It’s a global decision and will depend on scale which we will evaluate.” The brand currently imports its entire range.

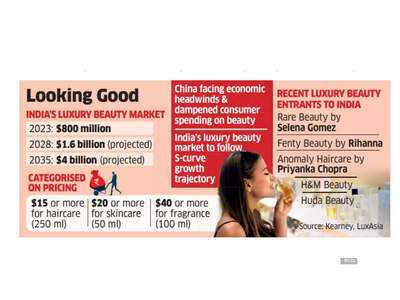

India’s luxury beauty products market is estimated to expand to $4 billion in sales by 2035, from $800 million in 2023, at a time when China is facing economic headwinds and dampened consumer spending in the segment, according to a report by consulting firm Kearney, along with luxury products retailer LuxAsia. “As scale builds up, makers of luxury cosmetics are starting to make in India,” Sharma said. “A few have already set up such facilities,” he added, though he declined to specify a time frame for starting manufacturing in the country.

The past year alone has seen luxury beauty labels Rare Beauty by Selena Gomez, Rihanna’s Fenty Beauty, Anomaly by Priyanka Chopra, H&M Beauty and Dubai’s Huda Beauty entering the Indian market.

“We have enquiries from two global celebrity-owned luxury beauty brands to find local partners to make in India,” an executive at a Delhi-based cosmetics importer said on condition of anonymity. “Even if these would likely be third-party associations to begin with, the global brands are looking for partnerships that are exclusive, for mid-tier pricing.”

US’ Estée Lauder Companies, which owns Mac, Bobbi Brown and Clinique, and the UK’s The Body Shop, which sells imported cosmetics in India through its local partner Quest Retail, along with other global brands such as Kiehl’s, Avon, Kylie Cosmetics and Max Factor, too are in the process of finalising manufacturing partners in the country.

Estee Lauder, which has nine global production sites across the US, Europe and Japan, has already launched some limited-edition products made in India through a third party. Its global president and chief executive Stéphane de La Faverie had said at a Barclays Consumer Staples conference in September that the cosmetics maker had approved a “massive investment” in India to cater to increasing aspirational demand. Without specifying the amount of investment, he had said, “In India, one of the winning strategies has been the deployment of small sizes. The ability to bring luxury products at a mass affordable price points, is going to be critical for us to win in the market.”

Tag Matters

An executive at an American cosmetics firm, who declined to be identified since he is not an authorised spokesperson, said, “We have started making two lip colour lines and foundation in India, and we sold during Diwali at prices 25% lower than our imported lines.”

Shiseido’s other flagship brand in India, French label Nars Cosmetics, recently entered into retail partnerships with online platforms Reliance Retail’s Tira and Nykaa, and set up its second standalone store.

The luxury beauty products segment is classified on the basis of pricing, with products priced above $15 (about Rs 1,317) for a 250 ml pack of haircare, $20 (Rs 1,756) or more for skincare for a 50 ml pack, and $40 (3,513) or more for a 100 ml bottle of fragrance.

Shriti Malhotra, executive chairperson of Quest Retail, which imports, distributes and markets The Body Shop in India, said, “We have introduced India-specific ranges that are produced locally, under The Body Shop and Avon labels.”

Currently, import duties on cosmetics comprise a 20% basic duty, 18% integrated goods and services tax and 10% social welfare surcharge.

Shiseido has 11 manufacturing plants including in Japan, China, Taiwan and the US, according to its global website.

“Local manufacturing would get the company inherent advantages, including lower duties, in the rapidly expanding India market,” Sanjay Sharma, country head of Shiseido Group in India, told ET. “It’s a global decision and will depend on scale which we will evaluate.” The brand currently imports its entire range.

India’s luxury beauty products market is estimated to expand to $4 billion in sales by 2035, from $800 million in 2023, at a time when China is facing economic headwinds and dampened consumer spending in the segment, according to a report by consulting firm Kearney, along with luxury products retailer LuxAsia. “As scale builds up, makers of luxury cosmetics are starting to make in India,” Sharma said. “A few have already set up such facilities,” he added, though he declined to specify a time frame for starting manufacturing in the country.

The past year alone has seen luxury beauty labels Rare Beauty by Selena Gomez, Rihanna’s Fenty Beauty, Anomaly by Priyanka Chopra, H&M Beauty and Dubai’s Huda Beauty entering the Indian market.

“We have enquiries from two global celebrity-owned luxury beauty brands to find local partners to make in India,” an executive at a Delhi-based cosmetics importer said on condition of anonymity. “Even if these would likely be third-party associations to begin with, the global brands are looking for partnerships that are exclusive, for mid-tier pricing.”

US’ Estée Lauder Companies, which owns Mac, Bobbi Brown and Clinique, and the UK’s The Body Shop, which sells imported cosmetics in India through its local partner Quest Retail, along with other global brands such as Kiehl’s, Avon, Kylie Cosmetics and Max Factor, too are in the process of finalising manufacturing partners in the country.

Estee Lauder, which has nine global production sites across the US, Europe and Japan, has already launched some limited-edition products made in India through a third party. Its global president and chief executive Stéphane de La Faverie had said at a Barclays Consumer Staples conference in September that the cosmetics maker had approved a “massive investment” in India to cater to increasing aspirational demand. Without specifying the amount of investment, he had said, “In India, one of the winning strategies has been the deployment of small sizes. The ability to bring luxury products at a mass affordable price points, is going to be critical for us to win in the market.”

Tag Matters

An executive at an American cosmetics firm, who declined to be identified since he is not an authorised spokesperson, said, “We have started making two lip colour lines and foundation in India, and we sold during Diwali at prices 25% lower than our imported lines.”

Shiseido’s other flagship brand in India, French label Nars Cosmetics, recently entered into retail partnerships with online platforms Reliance Retail’s Tira and Nykaa, and set up its second standalone store.

The luxury beauty products segment is classified on the basis of pricing, with products priced above $15 (about Rs 1,317) for a 250 ml pack of haircare, $20 (Rs 1,756) or more for skincare for a 50 ml pack, and $40 (3,513) or more for a 100 ml bottle of fragrance.

Shriti Malhotra, executive chairperson of Quest Retail, which imports, distributes and markets The Body Shop in India, said, “We have introduced India-specific ranges that are produced locally, under The Body Shop and Avon labels.”

Currently, import duties on cosmetics comprise a 20% basic duty, 18% integrated goods and services tax and 10% social welfare surcharge.

Shiseido has 11 manufacturing plants including in Japan, China, Taiwan and the US, according to its global website.

You may also like

Consensual relationship can't be criminalised: Karnataka HC

UK town in war over England flags as 'lefties' tear them down - A correction

Man Utd agreement reached on Ruben Amorim duo - 'He's going to hurt you'

SC rejects PIL seeking pan-India star-rating system for vehicles

"If high command decides, I'll complete my term": Karnataka CM on cabinet reshuffle