BlueStone’s IPO did not set the market on fire like some other recent startup listings, but that’s no surprise.

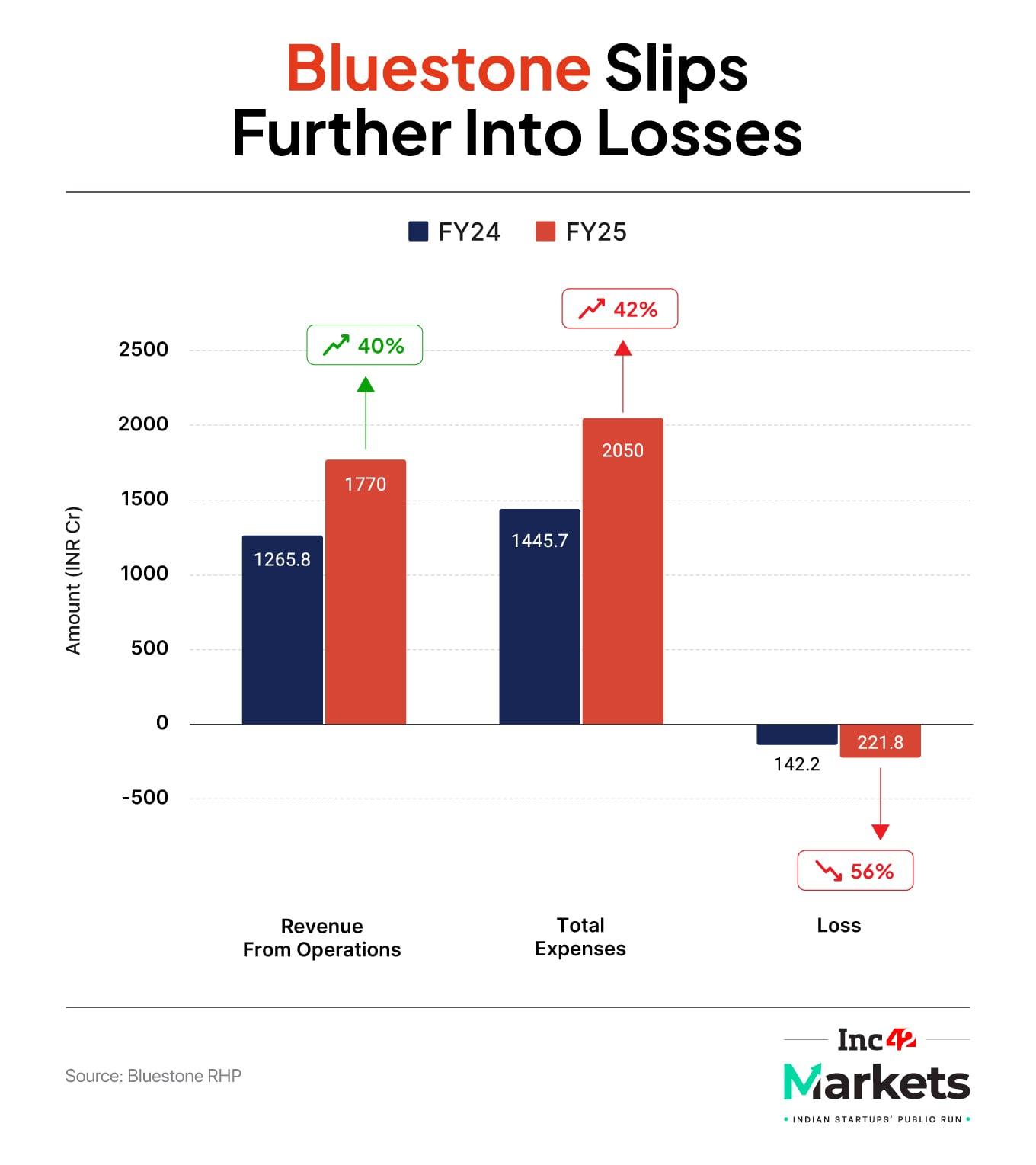

Despite a track record of over 14 years, BlueStone is yet to crack a profit. Most recently, net loss jumped 56% in FY25 to INR 221.8 Cr from INR 142.2 Cr the year before. And in a market that’s increasingly wisening up to loss-making IPOs and their trajectories, BlueStone found out the hard way.

Even the fact that it is the first jewellery ecommerce player to list was enough to capture the imagination of the public markets. BlueStone managed to pull in a final subscription of 2.7X, largely thanks to keen interest from institutional investors.

The IPO was priced between INR 492 and INR 517 per share, and the grey market premium barely scraped past 2%, signalling a rather restrained investor mood. When the company lists on the exchanges later this week, BlueStone could very well disappoint the IPO investors based on these indicators.

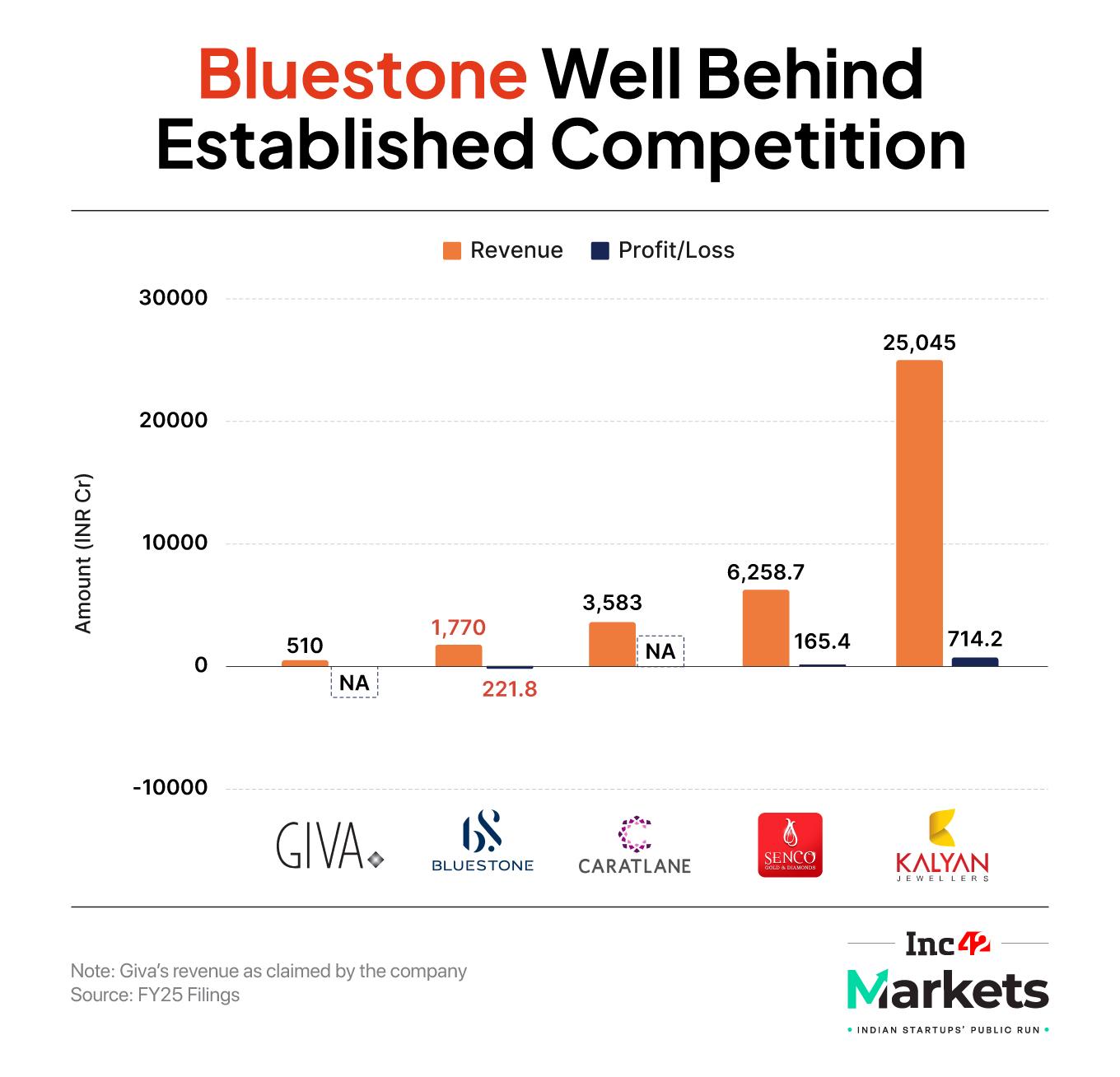

Launched in 2011, the Prosus-backed startup also did not have any significant competitors as an ecommerce player other than Titan-backed Caratlane. But times have changed. Players like Giva have emerged, while traditional jewellers are also racing to build omnichannel presence and roll out sleek, low-cost designs.

BlueStone is stepping into the public market at a moment when its early mover advantage has lost its shine. The profitability trade-off it made in favour of aggressive growth and heavy marketing spends is a classic startup journey. Now, as it steps into the public markets, it needs to find a clear path to profitability.

One way that BlueStone hopes to climb back into the black is through its offline stores. Ironically, this is the biggest focus area for the ecommerce player as the reality of online-only marketplaces has changed.

Company-owned store count has jumped from 155 in FY23 to 275 by FY25, spreading across 117 cities, a clear bet on building physical trust in the jewellery market. Marketing spends have nearly doubled to INR 159.2 Cr over the same period. This is a huge factor in BlueStone’s continued losses.

But the revenue mix is shifting sharply: offline channels are now driving the bulk of sales, while the company’s once-strong ecommerce business is losing ground.

Back in FY23, online sales brought in INR 120.4 Cr, about 15.6% of total revenue, while offline and other channels contributed 84.4%. By FY24, the online share had halved to just 8.5% at INR 107.9 Cr, while offline soared to over 91%.

In FY25, the pattern only deepened. Online sales ticked up slightly to INR 117.8 Cr, but their share slid further to 6.7%. Offline and other channels, on the other hand, generated INR 1,652.2 Cr, or 93.3% of revenue.

Bluestone’s omnichannel positioning sounds like a moat, at least the company has always tried to project that. But as analysts pointed out this might not be enough. “They were the first to do such huge volumes online, but for high-value jewellery, customers still want to see and touch it before buying. Offline expansion is inevitable but it is also expensive,” Kush Ghodasara, CMT, managing partner, InvestValue, said.

BlueStone’s biggest post-listing challenge will be walking the tightrope between profitability and its aggressive offline expansion.

Jewellery startup founders say even if customers browse online, purchases above INR 40,000–INR 50,000 are usually made after an in-store visit. People want to touch, feel, and try before they buy, and therefore an omnichannel model is imperative.

But going offline brings Bluestone into direct competition with Tanishq, Kalyan Jewellers, Malabar and other giants. “That means higher product quality expectations, more customisation, and a very different product mix. It will squeeze margins for at least three to four quarters,” Ghodasara added.

On the other hand, the retail segment of India’s jewellery industry is not exactly glittering right now. India’s gold consumption in 2025 is set to fall to a five-year low, as record-high prices dent jewellery purchases, overshadowing a slight boost in investment demand, the World Gold Council said last month.

The demand for luxury jewellery is also softening, even though weddings and festive celebrations show a bump. However, those in the industry say that everyday discretionary purchases are falling as prices climb. This is a cause for concern for BlueStone.

“When the Bluestone IPO launched, my first thought was that it’s overpriced,” a market analyst at a leading brokerage told Inc42. “Margins are shrinking across the industry. Bluestone has strong brand recall, but given its inventories and the valuation it was asking for, I find it hard to justify a long-term bet. Right now, I am not confident in the industry or the company.”

Jewellery Markets Needs A New Shine

Plus, Bluestone can no longer claim lightweight jewellery as its unique edge as legacy players have caught up. Titan has CaratLane, Kalyan Jewellers owns Candere, and Senco Gold has taken over Melorra.

Lab-grown diamonds are the latest trend, and Bluestone is betting on them too but purists still swear by real gold and diamonds, making it a segment whose hype may not last.

And with younger consumers rethinking jewellery altogether, the demand story is changing. “The new generation isn’t buying jewellery the way their parents did. They’d rather spend on travel or experiences. Gold as an investment is losing ground to other asset classes. What’s left is mostly functional or occasion-based demand,” Ghodasara said.

That leaves Bluestone stepping into the public market as one of the few digital-first jewellery brands among legacy-listed giants but whether it can shine as bright in the next two to three years remains the billion-rupee question.

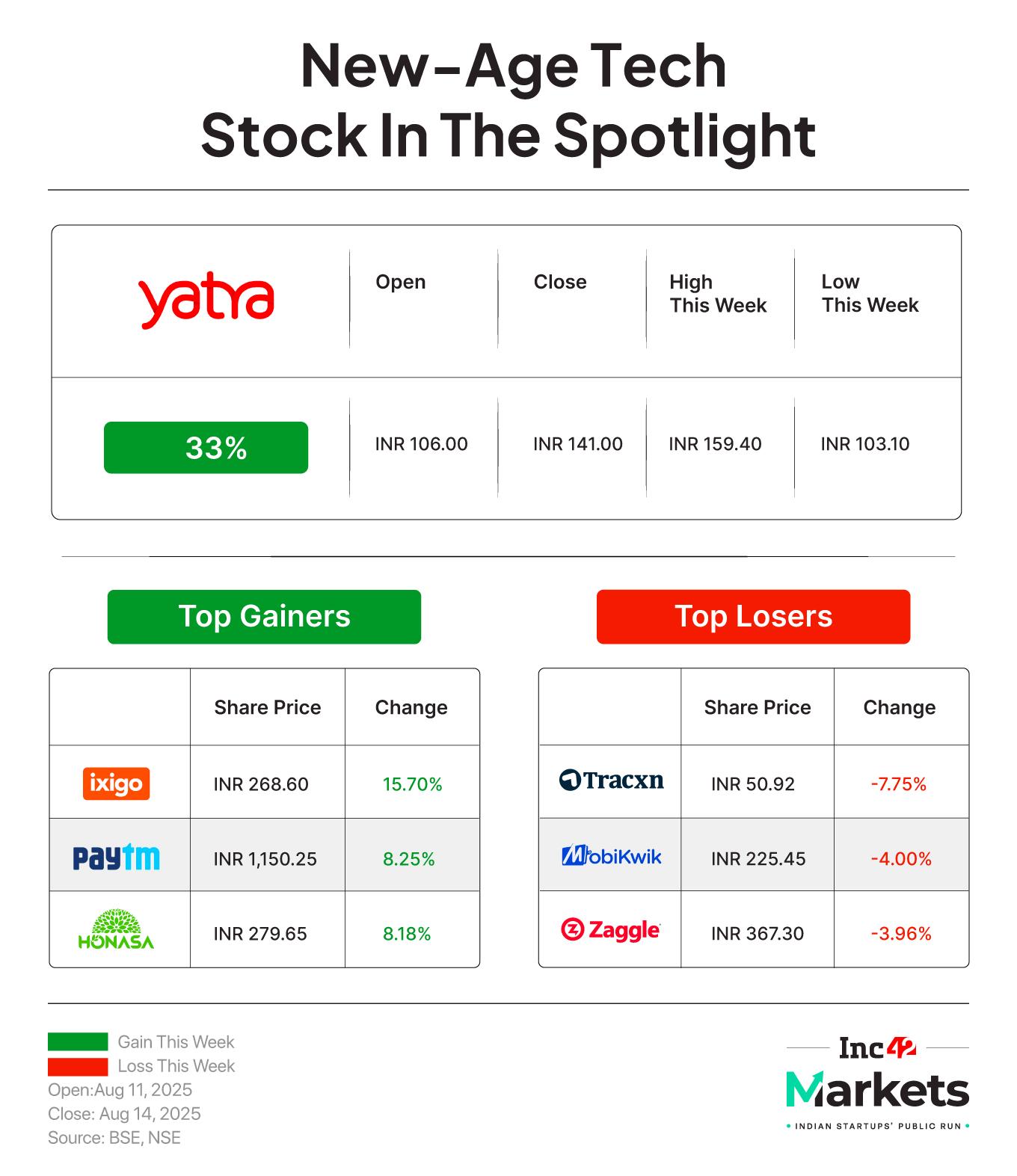

Markets Watch: New IPOs, Results And More- EaseMyTrip Q1 Profit Crash: The Online travel aggregator saw its consolidated net profit plunge about 99% to INR 44.3 Lakh in Q1 FY26 from INR 33.9 Cr in the same quarter last year

- Fractal Analytics Floats DRHP: The SaaS unicorn has filed its DRHP with markets regulator SEBI for an INR 4,900 Cr IPO

- Nazara’s Profit Doubles: Gaming giant Nazara’s net profit more than doubled to INR 51.3 Cr in Q1 FY26 from INR 23.6 Cr in the same quarter last year. Sequentially, profit skyrocketed 1,183% from INR 4 Cr

- Nykaa’s Growth Streak: Nykaa continued its profitable streak in Q1 FY26, with its consolidated net profit zooming nearly 80% to INR 24.5 Cr from INR 13.6 Cr in FY25

[Edited by Nikhil Subramaniam]

The post Bluestone’s Sparkle Fades In Bleak Jewellery Market appeared first on Inc42 Media.

You may also like

'If you are trying to brain-drain Bangalore...': US economist's H-1B explanation goes viral

Parenting experts address rising cases of postpartum depression among new mothers

Lesser-known national park has turquoise waters, dramatic cliffs and no crowds

Uttar Pradesh: Army jawan assaulted by toll plaza workers, NHAI imposes hefty fine, initiates process to cancel agency license

Captain Fresh Files Confidential Papers For $400 Mn IPO